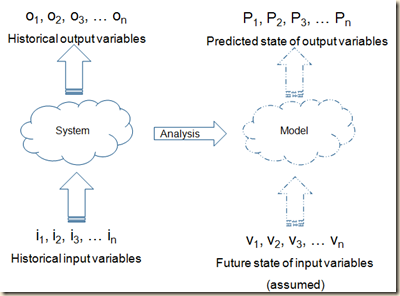

Forecasting and predictive analysis is used to model or predict future behavior of a system using previous observations or facts about the system. Such analysis is used extensively by scientists, economists and financial analysts in scientific as well as business applications.

Approach used for such analysis can be summarized as

- Identify facts or variables

- Categorize these variables in independent and dependent variables. Independent variables are inputs to the system. They are controlled by factors external to the system. Dependent variables are outcome or outputs of the system. Goal of predictive analysis is to predict dependent variables on the basis of a given combination of independent (input) variables.

- Through statistics or some other kind of analysis, find a set of mathematical equations that can mimic system, and replicate prediction of output variables from a given set of input variables.

Such analysis is frequently used by financial analysts to predict future stock prices, financial viability of a project, growth rates etc. Businesses use such models to predict supply, demand, prices and various other factors.

I have been developing my own models and using models generated by others for several years. Very often, as soon as people see a computer, spreadsheet or set of mathematical equations, they assume their results to be absolute truth. I would like to caution and share following comments.

- Model or a set of equations is only as good as data used to generate the model. If you use incorrect data as input to analysis, you will get a wrong model.

- Even if you have a good model, your predicted results will depend on accuracy of new set of input data. If you feed wrong data, you will get wrong results.

Recently I was looking at Altman-Z financial analysis presented at a web site. It was a very impressive analysis and gave very detailed in-depth recommendation on growth rate & future price targets. However, when I tried to verify the results, I found that this analysis was using incorrect historical stock prices. Thirty pages of recommendations were generated using incorrect set of input stock prices!

To conclude, always remember that predictive analysis depends on accuracy of

1. Historical data used for initial model building

2. Assumptions about future input variables.

you will get incorrect prediction if either of these are not inaccurate.

No comments:

Post a Comment